Zakat Facts – Who is Eligible and When is Payment Due?

Zakat is a charitable payment that is obligatory for all adult Muslims that meet and exceed the nisab threshold, making up the Third Pillar of Islam. As this form of charity is an obligation, rather than voluntary, there are certain restrictions on who can and cannot benefit from the donation of one’s Zakat.

Please note, Zakat should not be confused with Zakat al-Fitr, which is a compulsory payment to be made before Eid-al-Fitr commences.

For more Zakat facts, please keep reading for the main queries that are frequently asked both by those in and outside of the Muslim community.

Zakat Definition

Zakat is a charitable donation which is made annually under Islamic law. It is applicable on all assets, qualifying property and disposable income. Zakat is the fourth of the Five Pillars of Islam.

What Does Zakat Mean?

The literal meaning of Zakat is “that which purifies”, and it is considered to purify the wealth which is typically generated as income.

When is Zakat due in 2021?

Zakat can be paid at any point in the year, as long as you are above the nisab threshold (which is the point you become eligible to pay Zakat). Payment is due after on full Hawl (lunar year) from when you went over the nisab threshold.

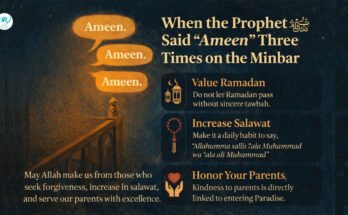

Can we Give Zakat Before Ramadan?

Zakat can be paid at any point in the year – before, after or during Ramadan. However, many Muslims choose to make their Zakat payment during the Holy month as they believe the rewards that come as a result of this are multiplied. Zakat should not be mistaken for Zakat al-Fitr (also known as Fitrana), which is a donation that must be made during Ramadan by every adult Muslim who has food in excess of their needs.

Can You Give Zakat to Build a Mosque?

Zakat is permitted to be spent in eight ways as specified by Allah in the aayah, which are for:

- The poor (al-fuqara) – someone with little to no income

- The needy {al-masakin) – someone in difficulty

- Zakat administrators – such as charities

- New Muslims and friends of the Islamic community

- Those in bondage – such as slaves and captives

- Those in debt

- For the cause of Allah

- The wayfarer – those who are stranded and/or travelling with little resources

As mosques are not listed amongst the eight categories, it is not permissible to use your Zakat donation to fund the building of a mosque.

Can You Give Zakat for Education?

It is not permissible to give Zakat to fund education settings such as school. This is because Zakat is intended to be given to someone in need who does not have anything and/or for the cause of Allah. If the schools’ students qualify for Zakat, then it would be permissible for them to receive the donation.

Can You Pay Zakat on Behalf of Someone?

You can make a payment on behalf of someone else, such as a husband paying Zakat on behalf of his wife. The person that you are paying Zakat on behalf of must know and authorise the payment, whether explicitly or implicitly.

Can a Mother Give Zakat to Her Son?

It is not permitted for a mother to pay Zakat to her son as you cannot pay for your dependents’ expenses from this charitable payment. Paying for a dependent’s expenses when they do not have the financial means to do so is obligatory and if you are unable to do so, others (relatives or otherwise) are permitted to donate their Zakat as long as they are not obliged to provide for them.

Can I Give Zakat to my Husband or Wife?

It is permissible for a wife to give her Zakat to her husband assuming he is deserving of receiving the charity (i.e. is in debt). However, a husband cannot donate his Zakat to his wife as he is already obliged to spend money on her and pay for her expenses; if he is unable to support his wife, others not obliged to pay for her expenses are permitted to donate their Zakat to them.

Can I Give Zakat to my Aunt or Uncle?

You are permitted to donate your Zakat to aunts and uncles if they are worthy of the charity, as, while they are relatives, you do not have any obligation to support them financially. In turn, your aunts and uncles would also be able to donate their Zakat payment to you if you qualified to receive the charitable payment.

Can we Give Zakat to Our Parents?

Zakat is not permitted to be paid to parents for the same reason as mothers and fathers cannot give their charity to their children. We have an obligation to support our parents as we enter adulthood as they, too, are obliged to support us as children– benefits between parents and children are shared and you are not entitled to benefit from your Zakat payment. Simply put, neither a son nor daughter can give Zakat to his/her parents.

Can we Give Zakat to Sisters or Brothers?

As a sibling is not considered to be a direct responsibility to support financially, it is permitted to donate your Zakat to any of your brothers and sisters, on the assumption that they qualify to receive the charity.

Can We Give Zakat to Syed?

According to the holy Qur’an, descendants of the Prophet (PBUH) are not eligible to receive Zakat payment, or any charity (including Sadaqah), even if they are poor. Anyone with the name Syed who have found themselves fallen on hard times can and should be helped by their Muslims Brothers and Sisters, as long as this is not through charitable obligations.

Do I Need to Pay Zakat on Land?

Zakat is not payable on land such as the family home or from where you conduct your business, such as any commercial property (office, shop or factory etc…). Any land that generates income, such as letting out a property as a landlord, is considered to be a capital asset and Zakat is applied to the income that is generated, rather than the valuation of the property itself.

However, if you have bought land with the intention of selling it on reasonably quickly (such as in the next few months to a year), it is treated as commercial goods and thus Zakat is liable. Zakat should be calculated based on the value of the land on the date the owner pays Zakat. If you do not own the land outright, you should only pay Zakat on the percentage that you own – this means if you own 50% of land valued at £200,000, you are only liable for paying Zakat on £100,000.

Land that has been retained for years, even if it has always

How Many Types of Zakat in Islam?

There are two different types of Zakat that Muslims are obligated to pay. The first of which is Zakat ul-Mal, commonly referred to simply as Zakat, which translates as the “cleansing of wealth”, which can be completed by qualifying Muslims at any point of the year. The second type is Zakat ul-Fitr, also called Fitrana, is donation of food made during the month of Ramadan before the Eid prayer.

Source : www.muslimaid.org

Aslm . It’s a question rather than a comment.

Can Zakah be used to buy foodstuffs at beginning of Ramadaan and then be distributed among poor and or needy muslim people in the form of food parcels ? Please advise

Correct.